Many plans offer target date funds (TDFs)

TDF basics

Sometimes referred to as life cycle funds, TDFs are often mutual funds or collective investment trusts (CITs), meaning they pool together money from many investors who have similar objectives. Target date fund managers commonly invest in other mutual funds, which may include stocks (shares of companies), bonds (debts similar to IOUs) and other types of investments.

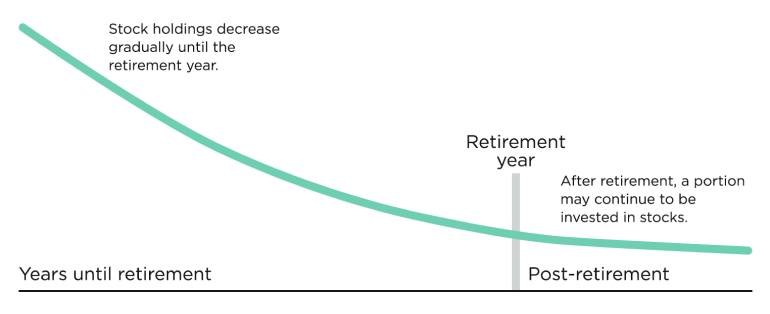

Regardless of what the fund manager invests in, the TDFs’ asset allocation — or the way the investments are divided among asset types — becomes more conservative as the target date nears. These funds often start out containing a higher percentage of stocks, which carry more risk but create growth. Then, they gradually shift to containing a higher percentage of bonds and other low-risk assets intended to preserve savings and create income.

How a TDF works

Log in to see the target date funds available in your plan.